Key Takeaway:

- How the CRED does is the first choice of customer’s when it is mostly running in loss

- How the company is managing to be so much engaging to the customer.

- Marketing Strategies of CRED.

It has been a long time since we have been utilizing multiple credit cards as a feature of our everyday lifestyle. Sometimes it also transforms into a horrible nightmare where we have not been certain to understand or predict which card had how much equilibrium left or which card was smarter to use in which outlets. We always wanted a way of dealing with all the various cards significantly more rapidly and advantageously. So let us look at how CRED can facilitate this specific issue.

What is CRED?

CRED is a Fintech organization established in 2018 by a praised and renowned business visionary Kunal Shah in Bangalore. It is an NPCI (National Payments Corporation Of India) endorsed stage that basically handles credit card charge installment transactions. CRED was probably the quickest and fastest startup to turn into a unicorn in 2021 and as of now, it is esteemed at $2.2 Billion as of April 2021.

There was consistently been an interest for a tenable component that guarantees that all Credit card bills were paid on schedule and that guarantees that the clients will not be charged a fine for defaulting on the installment plans. CRED takes advantage of this interest. As well as guaranteeing that the clients would be taken care of their bills on schedule, they are additionally given compensations for every exchange made on this platform for credit cards.

Well, we all wonders about how does CRED bring in cash? What are CRED’s business plans and income models? So, let’s bring up some light on it. For more information visit our website by clicking here.

CRED Business Model

- Client Value Proposition: CRED offers an assortment of significant worth propositions primarily through its portable application downloaded from either Google Play Store or iOS App Store. Clients then, at that point, are needed to present their portable numbers, email locations, and name to the application.

The stage then, at that point, utilizes the data to set up a client profile and adds all the charge cards connected to the given portable number to the recently made client profile. CRED has planned a clear and simple to-utilize UX/UI. The clients are enchanted with the application, which is reflected in its 4.7 rating on the Google Play Store.

This platform allows credit card users to manage multiple cards along with an analysis of their credit score. For instance, members with a high score are eligible for exclusive rewards upon payment of their credit card bills through the app.

- Bill Payments: Facilitating the installment of Credit card bills through the stage. When it comes to paying a credit card bill on time, CRED is the ultimate solution. CRED offers an easy and quick payment process to make credit card bill payments. You can make payment using a credit card, net banking, or via UPI.

- CRED Coins: All bill installments are remunerated with CRED coins that can be redeemed as offers or cashback in Cred Store. The separating part here is that the client gets a similar measure of CRED coins as the bill sum that was paid.

- CRED Cash: With CRED Cash, members are pre-approved for an active credit line of up to 5,00,000 RS with no forms, documents, phone calls, or physical visits. In three steps, CRED members can draw down any amount from their available limit at any hour of the day, and instantly receive the selected amount in their bank accounts.

- CRED Store: It allows CRED members to shop through their in-app e-commerce service, which features a hand-picked selection of premium products as well as travel experiences to exotic destinations around the world at member-exclusive prices.

- CRED Rent Pay: It enables users to make large recurring payments on their credit cards while also keeping track of their other expenditures.

Members can also win a month of rent

Free living or a home appliance cover worth up to Rs. 1 lakh from an insurance company.

- CRED Mint: It enables you to manage your idle money by facilitating higher rates of interest than most traditional methods. This service will allow you to lend money to other users and gain up to 9% interest per annum on the amount you have given out as loans.

Target Customer Segment

As a business, Cred targets particular niche customer. CRED plans to catch the wealthy area (falling in the NCCS A and NCCS B classification) who have more than 1 or 2 credit cards. Notwithstanding the financial segmentation, CRED further refined its objective clients by permitting just clients with a CIBIL score of at least 750.

Any candidate with a lower financial assessment is shipped off the shortlist until their FICO rating improves or the organization strategy changes of customers. This outcome in CRED having a princely client base with a demonstrated history of regarding their credit responsibilities, decreasing the likelihood of deceitful clients adversely affecting the stage’s activities. The realistic underneath clarifies factors on which CIBIL score depends:

- Credit History: All close to home and credit-related data including remarkable sums, discounts, and so forth is grouped by the Credit Bureau.

- Credit Utilization: How a significant part of the accessible credit sum has been benefited by the person. It is determined by isolating as far as possible by the credit benefited.

- Credit Mix and Duration: Composition of the advance portfolio between got advances (with insurance like car, house advance) and unstable advances.

- Different Factors: The number of credit card applications and different variables.

How does Cred Make cash? What is its income model?

CRED makes income on the accompanying fronts:

- Postings from accomplice brands: CRED displays offers and items from various organizations on the CRED store stage at a cost or fee. In this way, brand and item owners pay an e-commerce aggregator such as Amazon to view the item. It offers a switch from Amazon gift cards to design retailers and more.

CRED recently introduced restrictions on partnerships with various brands such as The Man Company, IXIGO, and Cult Fit. Every time a customer applies and benefits from a proposal, CRED receives a commission from another person.

- Commission from CRED Rent Pay: CRED allows customers to set programmed repeating installments like lease, EMI, and so on. In going back for this help, CRED expenses a fee of around 1% to 1.5% of the alternate sum as a fee from the client. Commission from CRED Cash.

CRED Cash is a speedy low-premium credit line given in the CRED application by partnered banks. For each fruitful credit dispensing, CRED charges around 1% to 2% commission of the exchange sum from the bank.

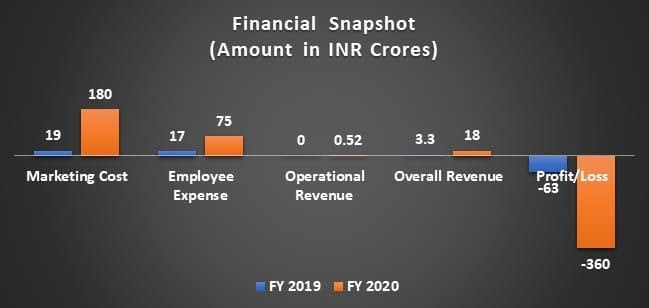

- Interest Income on Deposits: CRED brings in revenue on cash stores by clients. This was the most elevated and practically income produced by CRED in both FY 2019 at INR 3.03 Crore and FY 2020 at INR 17.5 Crore.

CRED’s Marketing system

CRED focuses on expanding its customer base, and the presentation methodology revolves around this premise. Therefore, CRED has focused primarily on advertising techniques. ATL (Above the Line) exercises such as TV announcements and occasional sponsorships to draw attention to the stage and its benefits.

The whimsical, noticeable list of stars from different territories was very appealing to attract attention. The program includes the past time from superstars Bappy Lahree, Anil Kapoor and Madhuri Dixit to Rahul Dravid and such as Olympic champion Neeraj Chopra.

To gain a higher share of customer spirit and credibility, CRED has also signed further contracts with the super-famous Indian Premier League, which will support its authority from 2020 to 2022.

The IPL season is similar to India’s fun season with viewers beyond several other programs or types, including the most reliable GEC (General Entertainment Category-TV Shows and Other Distraction Channels) classification. Nonetheless, this is due to an 850% increase in the cost of CRED from 19 rupees in 2019 to 180 rupees in 2020.

CRED has a solid understanding of local marketing methodologies. Financing means taking advantage of current stories and opportunities to fulfill our mission around them. Its purpose is to piggyback on issues that are becoming more important in the media channel.

With almost every announcement, CRED had the opportunity to create a brand buzz by choosing the ideal promotion at the right time. A recently submitted ad featuring Indian Olympic star Neeraj Chopra has received a lot of praise. The list ranges from Bollywood actors and singers such as Udit Narayan, Bappy Lahree and Anil Kapoor to cricketers such as Rahul Dravid and more recently Kapil Dev.

Further, let’s understand with an example,

- Sending Cakes – A Customer Acquisition Strategy using Existing Users.

Imagine on Tuesday working on a boring day shift job and suddenly getting a cake out of nowhere in return for paying your invoice. I’m happy. Yes, Cred did. In 2019, Cred attempted this customer acquisition step for colleagues from existing users. I just sent the cake to the user’s workspace, so at some point, each colleague asked, “Who sent this cake?” And the user naturally said, “For credit, invoice payment. It’s an app “. A guaranteed app download will be generated.

- Content Marketing Strategy of Cred.

As it is mentioned, CRED’s goal is to make Indians financial literate and trusted borrowers. To achieve this, we manage a credit card, general finance, and fintech blogs on our website.

As part of the CRED on the Money series, we publish financial content on YouTube.

And curious Kunal Shah publishes podcast-like content on topics related to money, startups, and trends in conversations with various professionals and entrepreneurs as part of the CRED-Curios series. increase.

- Viral Marketing.

CRED really deserves a high class of appreciation for its engagement strategy. CRED knows how to get viral. There is not just one but many cases when CRED’s ads and viral stunts got them trending.

- Twitter Marketing.

Supporting tweets from other brands.

Brands promoting yourself on social media. One brand is good, but another brand that promotes your brand on social media is great. CRED uses the Twitter platform to promote its brand and is also promoted by other brands. Brands such as Amul, Zomato, MPL, and Zostel’s tweets in Rahul Dravid’s viral ads provided CRED with more brand coverage. When these popular brands used CRED’s viral content, CRED’s brand awareness also increased.

- Owner’s marketing.

Kunal Shah uses the Twitter platform for personal branding to help earn the trust of its customers. When we hear about Kunal Shah today, we associate him with CRED.

This is how personal branding makes owners and brands synonymous. Kunal Shah tweeted about various financial topics, participated in current discussions, and shared his personal views on the startup community. This is known to make the most of Twitter.

How has CRED performed up until this point?

The credit card charge installments space is an exceptionally divided and untouched industry, with individual private banks depending on their portable application and site through which they charge installments are finished. Most of these applications are clustered to utilize and are inclined to visit crashes. This makes a critical bottleneck and problem area for new and existing clients of Visas and MasterCard’s.

CRED simplifies these trouble spots with its simple to-utilize and eye-pleasing UI and the comfort of accumulating cards having a place with various suppliers. The motivator plan of compensating charge installments has worked till now for CRED, previously procuring around 7.5 million clients, and presently accounts for 20% of all the Master card installments in India which in the initial stage is huge.

Notwithstanding approaching a rich base, CRED isn’t beneficial right now and was vigorously reprimanded by various industry observers for bringing about substantial misfortunes while creating a relatively unimportant income.

Let’s see the financial snapshot of two years.

It was said that MR. Kunal Shah spent RS. 727 to earn a rupee in FY20.

CONCLUSION

The CRED phase means changing the way customers pay invoices using MasterCard. This stage has acquired about 7.5 million wealthy customers with a proven history, and their general income has increased to 18 rupees several times in 2020.

Nevertheless, CRED has been hit by great misfortune and has not previously considered a particular coordination path. With extraordinary expectations, the entire company and viewers are confident that CRED will discover ways to customize it to leverage its customer base.

As we are enthusiastic, the main research revolves around the subject of income-age planning. Will CRED reduce gifts and urges, and after a closer look, will it start billing clients to control the exchange, or will CRED embark on a whole new path to tracking acceptable sources of income?

Will the administrations, such as Rent Pay and CRED Mint generate a reasonable source of income? Only the reality of the situation will be finally revealed. For now, continue to enjoy CRED.

[Read more: https://www.moneycontrol.com/news/business/the-story-behind-creds-800-million-climb-within-two-years-6179661.html/amp]

Abbas Ali

Content writer

Prerna Kumari

Graphic designer

Dharmit Rane

Editor

Good work Bhavika

It’s remarkable for me to have a web page, which is beneficial

for my know-how. thanks admin